Realty Perspective – June 2023

After 7 years of incredible property price increases, we all knew that a change in the market was inevitable, yet it probably hit harder than some of us expected. The combination of inflation, rising interest rates and tax changes has changed the real estate landscape.

We will delve into this information further, look at the current market movements and where they might go, as well as some advice for people wondering what to do in this market.

Historic Cycles

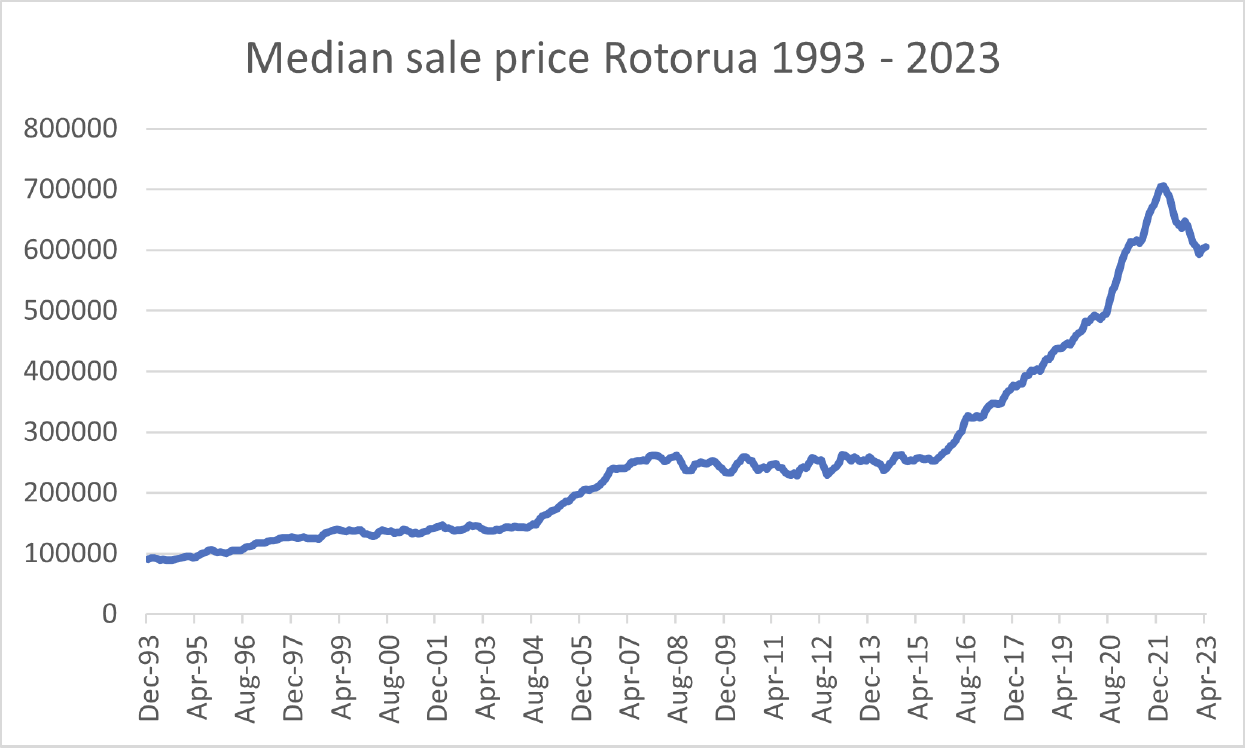

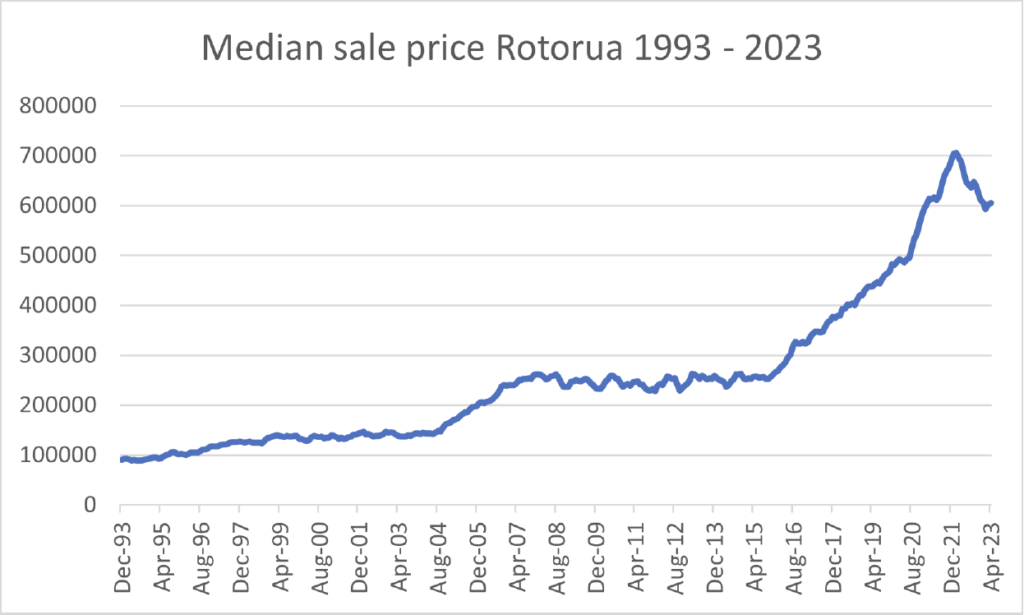

The property market in NZ has always shown to be cyclic. They often refer to a 7-year cycle, but looking back at the last 30 years, we can see this is closer to a 10-year cycle. Below is a graph that shows median sale prices since 1992. Before the GFC, we had 5 years of property price increases in a buoyant market (between 2003-2008), compared to 6 years the previous cycle (1993-1999) and 7 years in the last cycle (2015-2022). You’ll see in the graph that the downturn this time is much greater than the previous years, which may be a correction of the extra 1-2 years of price increases that weren’t sustainable compared to previous cycles.

When will things stabilize?

Looking at market movements and the most current property data, I think we are nearing the end of the prices dropping. Statistics don’t always tell us the whole story either. When fewer properties sell, the variations can be much greater. Looking into statistics a bit deeper, we can see that the properties representing the median sale price now are of a lesser quality than 12-24 months ago due to the price distribution (ie. there is a larger share of inferior properties selling compared to 12 and 24 months ago). This is no surprise with investors offloading prop-erties and first home buyers being quite active right now. When we are comparing data to determine price movement, we have to compare apples with apples, which isn’t always the case with the property data present-ed currently.

There are a few variables that will determine whether we will see further price drops or not. At this point it doesn’t look like this will be the case and prices appear to be stabilizing. The 3-year interest rates are coming down, which suggests the banks are not expecting mortgage rates to go up much more. Stock levels (number of properties on the market) are stabilizing and hovering around 500 in Rotorua (it has come down from 540 since the start of 2023 to approx. 480 in May 2023). A few things will have an impact on the market and may influence its future movement:

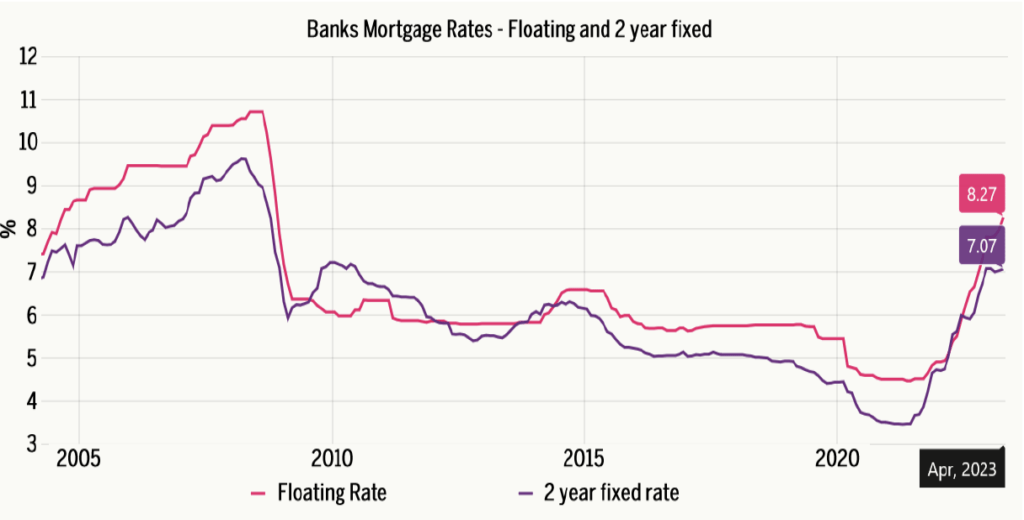

Interest rates

Homeowners who fixed their interest rates for 2-3 years in 2021 may not have felt the interest rate increases yet. When they come off their fixed rates the difference can easily be 3-4% and result in increased financial pressure.

On the flipside, as interest rates settle down, and perhaps come down in the near future, it might increase the number of people feeling comfortable purchasing or upgrading again creating greater buyer activity.

If stock levels increase, we might find ourselves in a buyers’ market, but at this point this is not happening (the opposite is actually the case with stock levels dropping slowly – this, however, could just be a seasonal adjustment with winter just around the corner).

Impact of inflation

The combination of inflation and increased interest rates may result in more mortgagee sales. Hopefully this won’t happen, but if it does, it may force the market down a bit further. We haven’t seen many in Rotorua, but several are popping up in Auckland.

Stock levels

Currently we are in a Balanced Market, where neither the buyer nor the seller has a distinct advantage over the other. There are more properties to choose from compared to 2 years ago, but buyers still don’t have the upper hand across all price brackets. In 2014 there were more than 1000 properties on the market with very few peo-ple buying, which we can call a buyer’s market. The media regularly refers to the current market being a “buyer’s market”, however, they don’t look further back than the last 5 years. If a cycle has stretched to a 10 year period, you have to look a bit further back to get a true understanding of the market we’re in. If stock levels increase, we might find ourselves in a buyers’ market, but at this point this is not happening (the opposite is actually the case with stock levels dropping slowly – this, however, could just be a seasonal adjust-ment with winter just around the corner).

Elections

With elections looming, many people are holding off on making any decisions. I don’t know how much change we’ll see and how that will impact on the property market. If we have a National government, some of the tax relief will cause people to offload their investment properties sooner (bright-line test changes), whilst others might hold onto their properties for longer (interest deductibility). What this will do to the housing stock (supply of properties) is hard to predict.

Summary

There are many variables at play and looking at historic cycles, we will likely be in a market with no change in prices for some years to come. No great losses, and no great gains. Any of the factors above will affect the mar-ket, but mostly I predict it to be a “steady” market for the years ahead. 3-4 years down the road we will likely find ourselves at the start of a Property Boom again, with price increases and everything we have seen in the last few years.

This is one of the most common questions I get asked. For most people, the right advice is to sell when it suits them. If you want to sell in the next couple of years and want to maximise the potential sales value, I don’t think there is any benefit in waiting. The market isn’t going to improve to such an extent that it will have a positive im-pact on your nett result. The risk of the market moving towards a buyer’s market is greater than a move towards a seller’s market. The government is easing restrictions because they don’t think prices will drop much further, but the last thing they’d want to see is another hike in property prices.

When to sell?

If you are an investor and want to benefit from future capital gains, you’ll need to be ready for a long ride. Keep your property for 7+ years and you’ll ride out the coming “flat” years and enjoy the next up-cycle. Sometimes people tell me they’ll wait for the market to get better in 2 or 3 years before they sell. If you are thinking along those lines, you might as well wait another 3 years to get 10-15% gains year-on-year which puts you close to the 7-year period I referred to earlier. Long-term property investment is a great strategy, but right now, the emphasis is on “Long-Term”.

If you are looking to buy and sell in the same market, I would pick the time that suits you best. And make sure you have a home to move to before you put your house on the market as it is still a struggle for many to find a suitable home in a short timeframe.

And finally, if you are looking to buy, just go for it. Maybe prices will drop more…Maybe not… Nothing has changed in some ways: “we won’t know when we have hit the bottom until we’re passed it.”