Free Market vs Government Intervention

- 24/05/2021

- Real Estate

- 0

The last 12 months of real estate trends have been like a rollercoaster ride.

- First the experts predicted a huge downturn (April-May 2020) and the government loosened finance restrictions (such as Loan-to-value ratios for investors) to ensure properties continued selling through the predicted downturn as a way to stimulate the economy.

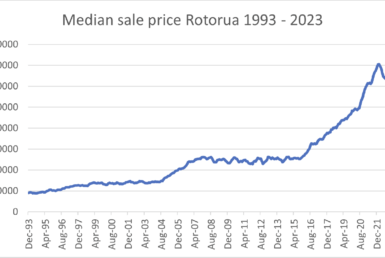

- Next we find out supply remained low, demand high (increased by the returning Kiwi) and prices continued to rise. The country’s housing crisis (which has been a point of discussion for years and well before the 20% price increase we have seen in the last 12 months alone) is at a new level again which resulted in new government intervention introduced in March.

- Within 12 months, the government loosened the rules and subsequently tightened them again to try and control house prices. The big question is: will it have the desired effect?

Regardless of which camp you’re in based on your political beliefs, it has been a rollercoaster ride since the first COVID-19 lockdown with unprecedented market movements and a lot of uncertainty. What does this mean for you?

A summary of the latest changes

The major changes are an extension of the bright-line test for investment properties from 5 to 10 years (not including new builds), and the end to the interest deduction on residential property income. There are some minor changes to eligibility criteria for government support for first home buyers but for the Rotorua region nothing has changed here.

Bright-line test – from 5 to 10 years

In short it means that any property that is not the main home purchased after 27 March 2021 and sold within 10 years will be taxed on the capital gains. There are exclusions and pro-rata calculations for change of use (maybe you lived in it for 2 years and rented it out for 3), but the overall intention is to tax the capital gains if you sell within 10 years and it wasn’t your main home for the entire duration.

Interest deduction on residential property income

This is a major change as it will affect cash-flow quite considerably for most investors. Interest deduction has always been a big part of the equation for investors to try and stay tax-neutral on their residential property portfolios. A typical $500k loan at 3% for an investment property will now attract an additional tax of approx. $5k annually for the landlord.

What’s next?

The recent changes will likely have a flow-on effect with investors in two different ways. Some investors will decide to sell as the changes to the healthy homes act combined with these recent announcements will make property investment less attractive. The other “solution” landlords are talking about is passing these extra costs on to renters by increasing rents. Although this seems a logical option, I don’t think it will get much traction as the rents are already high (50% of an average income to cover average rent), it also would need to be a huge increase of rent to cover the extra cost as the increase will get taxed also (based on the illustration above, the total rent increase would have to be approx. $125pw).

The BIG question is….

….to what extent will this change the marketplace and what should you do?

For most people it shouldn’t change any plans you may have, however, if you have been waiting for the market to peak and maximising the opportunity to sell for top-dollar, there are a number of indicators that would suggest now is a good time. We will never know when we have reached the top of the market until we have passed it, but there are some indicators that suggest a softening of the market.

I make a reference above to the market softening, which isn’t the same as a downturn. I think we’ll see a greater balance in supply and demand, which will result in slightly longer timeframes before properties are sold. The buying activity from investors moving forward will be different which will ease competition amongst buyers and eventually will slow price increases down. How long these things take is hard to predict but I think we’ll continue to see prices increase in 2021 but at a slower pace with prices settling down in 2022/2023.

What should you do if….

….you are considering selling the house you live in:

My advice around this remains the same. Whether you are planning on upsizing, downsizing or moving to a different area, choose a timeframe that works for you and don’t let the market movements dictate your plans. The market is great now, but it will very likely still be fine in 6 months’ time. Worst case scenario, if prices do drop slightly in the future, the next house you are purchasing will also experience that drop.

….you are considering what to do with your investment property:

This is a more complicated question to answer. For some the change in interest deductibility will have a big impact on cashflow. For others it won’t make a huge difference depending on the size of the mortgages. Based on the above predictions, the market will likely be within 10% of the peak so depending on how good you are at predicting the peak, you could try and time it perfectly, but the longer you wait, the higher the chance of ending up at the other end of the peak.

….if you are looking to buy:

When you see a house you like, buy it.

Just remember that buying is a long-term financial commitment. If you buy now and keep it for the next 7+ years you will enjoy the next up-cycle of price increases. If you need to sell within a few years of buying, you may risk losing a little bit of money IF the market turns (this is not likely, but possible).