Decisions, decisions, decisions…….. or shall we just decide to make no decision????

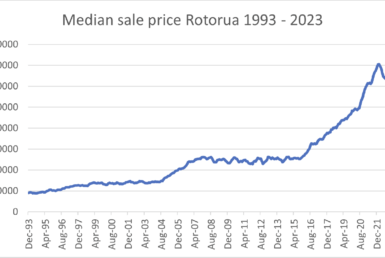

After many strong years of rising prices, it is quite hard to know what to do when it is clear we are passed the peak of a property market cycle. This old quote rings true: “you won’t know you are at the peak until it’s too late and you’re on the other side”.

Property values and the property market as a whole have taken a bit of a dive since the peak in 2021 and there is a consensus out there that we haven’t seen the end of this yet. The one thing we can’t seem to be able to agree on is for how much longer this will continue and what will happen on the other end: will we see property prices increase again, or will there be a long period of a “flat market” where property prices are neither falling nor rising?

The current state of the market in Rotorua

At the start of this year I predicted the number of sales to stabilise between 60-80 sales each months and the number of houses on the market to remain the same around the 400-450 with a possibility that this increases slowly whilst we remain in a balanced market where neither the seller or buyer has a clear advantage over the other.

We have been in this position for most of the year and it doesn’t look like this is changing. The current housing stock did increase past 450 at some point during winter, but has since dropped back again. The number of sales have fluctuated around 70 each month, which means the market conditions have remained mostly the same from a supply and demand perspective. What has changed significantly in the last 12-18 months are three factors that have had the biggest impact on property prices:

Interest rates

Interest rates have increased fast in the last 18 months, which has made a significant change to individual’s cash-flow positions. Not everyone has felt these yet as some people may have fixed their interest rates 18-24 months ago under 2.5% and will only see a change in interest payments when their fixed term comes to an end. It is expected to continue to rise in 2023 by another 1% which means market rates may go up to around 7-8%.

Inflation

Rising prices are common from year to year, but in the last 12 months we have seen extraordinary price increases due to the Ukraine-Russia conflict and the global economic instability. This together with interest rate increases has seen the biggest change in purchaser’s ability to buy houses at higher prices.

The Bank’s willingness to lend and tax changes

These two wrap up the third reason why prices have changed. The banks are more careful who they lend money to and are increasing the requirements and “safety margins/measures”. This has resulted in fewer people getting approved for a loan that they previously may have had approval for.

And investors have had to deal with the tax change around the deductibility of interest payments for rental properties. This, combined with the interest rate increases, has seen a real change in cash-flow and how much money investors need to top up their mortgage repayments

What we are seeing in the market now

With an increase in properties on the market and fewer people buying each month the biggest change is in the level of competition from both the seller and buyer’s perspective:

Buyers have more choice and are less likely to find themselves in a multi-offer situation. Sellers are competing against other sellers for the same buyer and for every property that sells in a month, there are 6 properties that don’t sell that month.

Helping sellers become the 1 that sells instead of being one of the 6 that don’t is the real estate agent’s job. With good information and marketing strategies, you’ll be able to navigate this smartly and make good decisions, however, many sellers find themselves in a position where they are the “victim of the market” as they missed the boat. The reality is that the right strategy will attract the right buyers and get any property sold. It’s just not as easy and straightforward as it may have been in the previous years where it didn’t matter what you did because the market would eventually catch up.

Where the market is going

Next year we will likely see price changes ease as we are settling into a more balanced market. There might be some movement, but not very significant.

The interest rates and cost of living is not going to be more favourably, nor is the overall employment status of NZ (which is very strong at the moment), so there will be no relief from a cash-flow perspective nor will it get easier to get loans.

With another election coming up, I think a large group of homeowners will be “change-averse” and only sell if there is a need for it, rather than a desire/want to upgrade or change scenery. This will likely result in similar number of properties on the market and similar number of buyers keeping the market in a balanced state. Cost of living will continue to rise as will interest rates, which may result in small changes to prices, but not likely in great changes.

In 2024 and beyond, the economy, interest rates and inflation (as well as the global stability) will likely stabilize and bring about a stronger economy with less uncertainty. I think this combined with an expected positive migration rate will likely create a stable real estate market which will remain balanced without dipping into an extreme buyers market like we experienced after the GFC with 1400 houses on the market and only 65 sell each month.

What should you do if….

….you are looking to buy but think house prices will likely decrease further?

My advice to buyers is to get pre-approved and get your finances sorted, start house hunting, research the market so you know what properties are worth and when you see a house you like, buy it.

You can wait for the “lowest point” in the market, but just as I mentioned before, you won’t know when you reached it until it is too late. Furthermore, in the near future, your interest rates will increase more than house prices will decrease (if that is going to happen at all). Ie a 1% change in interest rate from 6 to 7 is the same as a 16% increase in cost/interest payments. Even if prices do drop more, it won’t be by that much.

…you are worried whether you can afford the change in interest payments and inflation

Get some advice. You want to prepare for the storm, before the storm hits you. There are often options or habits you can implement, but none of them are good if you are under pressure and have-n’t prepared for it.

Try and find a solution early as keeping your home is likely the best option in the long run. You only want to sell if there is no better option, but if you find out you need to make a change, make it early whilst you’re in full control.