A seller’s market … but for how much longer?

- 05/09/2019

- Real Estate

- 0

Since my last market update, there have been numerous developments that create uncertainty about the market and for how long the upwards trend of property prices will continue.

The key changes we’ve seen in recent months:

• the lowest Official Cash Rate since its introduction 20 years ago

and the lowest interest rates since the 1970s

• high demand for properties both to buy and rent

• rental properties changing to owner-occupied

• Capital Gains Tax abandoned by the government

• The healthy homes act deadlines are looming, and purchasers

are getting cautious

My market update will look at how these have an impact on homeowners, investors and first-time buyers (or those who sold and don’t own a home at this point).

Upsizing, downsizing or changing location?

We see more properties being sold as part of a “chain” compared to previous months. Buying a property subject to your house selling is something that will become a more utilised solution moving forward. If you decide to sell first, be cautious, it still isn’t easy to find the right house for most people so if you have an extensive “wish-list” for your new home, make sure you have a look around first before you commit to selling.

The number of properties on the market is slightly up compared to the same time last year, but still low in comparison to previous years. Other options if you want to buy and sell in the same market are to buy with an extended settlement date and/or have bridging finance on standby.

Quality homes that are well maintained are continuing to sell well and we have no issue finding buyers across all price ranges. If there is outstanding work to be done, it may be worthwhile dealing with these before you take your property to the market to maximise your return.

Not sure what to tackle? Just give me a call – I often help homeowners with this question to make sure you get the greatest return on time, effort and money spent.

Not sure what to tackle? Just give me a call – I often help homeowners with this question to make sure you get the greatest return on time, effort and money spent.

Investors – it’s all about timing

Keeping property long term continues to be a great choice of investment in my opinion, but with the changes in legislation, your investment strategy may need adjusting to maximise return and minimise risk. The Healthy Homes Standard will affect new tenancies from July 2021 and all properties by 2024. The focus at the moment is insulation, ventilation, heating, moisture & drainage and draught-stopping. All relatively easy to deal with, but we have already seen quite a few landlords who have decided they want to get out of the market before they become law to avoid having to deal with it now.

The Healthy Homes Standard will affect new tenancies from July 2021 and all properties by 2024. The focus at the moment is insulation, ventilation, heating, moisture & drainage and draught-stopping. All relatively easy to deal with, but we have already seen quite a few landlords who have decided they want to get out of the market before they become law to avoid having to deal with it now.

Over the next 10 years, it is likely that these rules will be tightened again at a cost to the investor. With lower yields, higher cost and dropping net-returns, there may be alternative ways to invest your money. I continue to believe that property is a great investment and although I’m moving towards industrial/commercial investment myself, property will remain a great option long term.

If you are considering a different investment strategy in the next 24 months, now could be as good as any time to start this process. Although I don’t believe the market will likely drop, I don’t think the gains to be made in the next 24 months will necessarily outperform the risks and costs that will be linked to the changes coming.

For many investors, the news the government has ruled out an introduction of a Capital Gains Tax would have been well received. My suggestion is to have a look at property investment as a component of your overall investment strategy to see whether it is beneficial to change to a different mix.

If you’d like to discuss any options related to your property portfolio, I’d be more than happy to have a look at your properties and share my thoughts depending on what your goals are.

Purchasing your first home

Property ownership is a big part of life and the sooner you can get onto the property ladder, the more secure your financial position will likely be in the future. But there are a few caveats.

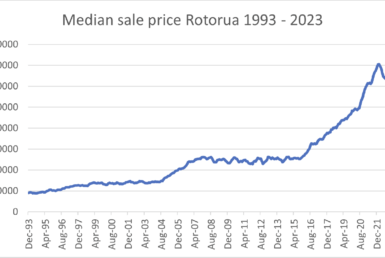

Looking at the figures, it makes perfect sense to buy a property as the interest rates are so low, you would likely be better off financially in comparison to renting on a cash flow. But especially so after taking in consideration the increase in property values and the decrease of your loan over time.

The things you should do if you aren’t yet:

Have a look at as many properties as possible and keep track of what they sell for. This will help you understand the market value of properties better but it will also be easier to recognise the house you really like. We quite regularly meet people who dismissed a house in the early stages, only to find out it was the best one suited for them after seeing many others.

Don’t work towards the limit your bank has set for you. I typically recommend buying a house approx. $50k cheaper than what you are approved at. This doesn’t work for everyone, but just because the bank is happy to lend you the money, doesn’t mean you should spend all of it. It’s nice to have a second bathroom and walk-in wardrobe, but they are not the features you’d typically find in a first home.

Be flexible with your “must-have’s”. Don’t buy a house with a master bedroom based on the size of your bed. It is sometimes cheaper to buy a new bed with the right house. Time is still of the essence. A house six months from now will be more expensive than it is today, based on the current market conditions, so get in there and start paying off your own mortgage as opposed to someone else’s.