What’s happening in the market and how does this affect me?

- 31/05/2018

- Real Estate

- 0

Property Market. We help you navigate through the wave of “exciting” headlines that are claiming sales are up one month and down the next. It is important to put things in perspective and make it relevant to your individual situation, which is exactly what we do.

Property Market. We help you navigate through the wave of “exciting” headlines that are claiming sales are up one month and down the next. It is important to put things in perspective and make it relevant to your individual situation, which is exactly what we do.

“What’s happening in the market and how does this affect me?” The question I get asked more than any other.

What will likely happen in the future:

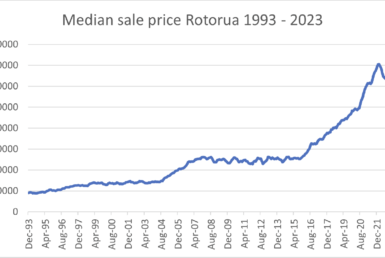

The biggest driver of increasing house prices is low supply & high demand. With multiple purchasers being interested in most properties we bring to the market and the supply being at its lowest level in the last ten years, I believe that we will continue to see prices increase. There are a few more subdivisions in the pipeline and a number of sections available at the moment, however, based on the cost to build and the increasing number of people seeing Rotorua as a destination, increasing property values in the coming 12 months is likely. These price increases will be at a slower rate in comparison to previous years so depending on your situation, it may affect whether it is better to hang-on to your property or sell.

- Rental prices have increased significantly in recent years and it looks like this has topped out. It is unlikely that rental prices will continue to rise much in the next few years.

- New regulations will affect the attractiveness of investment properties from a cash-flow perspective. Most property investors are investing to enjoy Capital Gain over a long term period, which will not be affected much by the new regulation. Property investment continues to be a great avenue to grow wealth and I don’t see it changing in the near future, however, the benefit of holding onto a property for just another year, is not likely going to see you benefit much financially.

- New Insulation requirements come into force in July 2019.

- Interest rates will likely increase in the next one to two years which will affect how much investors are prepared to pay for properties as this will negatively affect the cashflow and purchasing power.

There has been a significant change in how properties are bought and sold in recent months due to the low number of properties on the market and (in my opinion) the market coming within 20% of its peak on the “Growth Curve”.

What I mean with that is that based on market movements being cyclical, we are approaching the peak but aren’t quite there yet. Even though the number of properties on the market is at its lowest point in 10 years, purchasers aren’t rushing into buying and are doing more due diligence than a year ago.

We also see more sellers accepting offers subject to a purchaser’s property selling, which would have been turned down a year ago as there would typically be a cash buyer willing to pay the same. These are all indications that price increases are leveling off somewhat.

Being able to purchase something subject to selling your own house is one of the biggest developments that will assist many home owners in moving forward without too much risk.

If you are in a home and are considering moving, you could get the marketing of your property organised today, start looking for a house tomorrow and have all your ducks lined up to start the selling process as soon as you have found the right house.