Are we in a changing market?

- 21/03/2019

- Real Estate

- 0

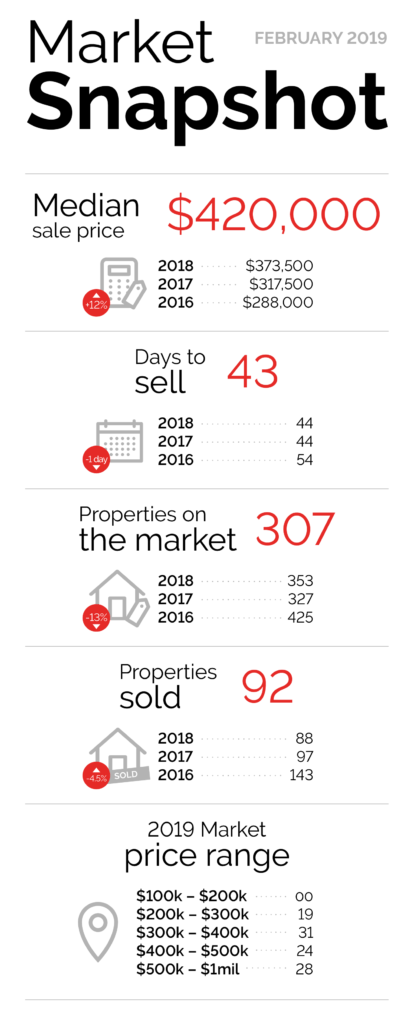

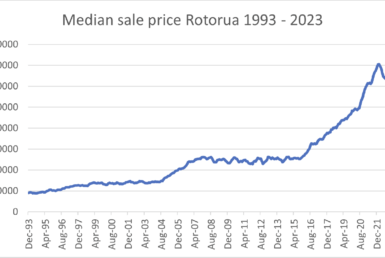

Supply and demand has changed market dynamics in Auckland and the question we get asked every day is what we expect to happen with prices in the Rotorua market. Will we follow Auckland and will prices drop, or will they continue to climb?

There are a number of key economic factors that will affect the market as well as new legislation to be introduced in the coming years. I believe that prices in Rotorua will continue to rise, however, at a slower rate than we have seen in the past three years. A key difference between the Auckland and Rotorua market is the rate of growth in the last five years and the current supply and demand levels.

There are a number of key economic factors that will affect the market as well as new legislation to be introduced in the coming years. I believe that prices in Rotorua will continue to rise, however, at a slower rate than we have seen in the past three years. A key difference between the Auckland and Rotorua market is the rate of growth in the last five years and the current supply and demand levels.

Auckland property prices shot up at a much faster rate than Rotorua, which is not sustainable and contributes to the slow-down Auckland is currently experiencing. The current supply and demand is also quite different. In real estate they often refer to stock levels in terms of “Number of months of supply”.

In Auckland this currently sits around 7.5 months, whereas Rotorua is only 3.2 months (Hamilton & Tauranga have 3.5 months of supply). This means that if no properties would come to the market, it would only take 3.2 months for the current housing stock to be sold, in comparison to 7.5 months in Auckland.

There is some uncertainty in the market driven by two pieces of legislation in the making.

Both the Healthy Homes Standard (which is likely coming into effect in mid-2019) and the capital gains tax recommendations made by the government’s Tax Working Group (likely to come into effect mid-2020), will have an impact on how people look at property as an investment.

At this point they are only recommendations and it won’t become law until after the next elections (which means a new government could repeal it). As this doesn’t affect the family home, it will only affect investors who have holiday homes or investment properties.

My recommendation for homeowners

There’s no hurry to sell now if you are going to purchase again and haven’t found the right home yet. My recommendation generally is to NOT sell unless you have a solid plan in place for your next purchase as it might take some time before you find something suitable.

There’s no hurry to sell now if you are going to purchase again and haven’t found the right home yet. My recommendation generally is to NOT sell unless you have a solid plan in place for your next purchase as it might take some time before you find something suitable.

I have seen many people ending up homeless because they were told it would be easy to find something suitable once they had sold and were in a “cash-position”, only to find out the reality is quite different.

With more properties coming to the market, it will become a little bit easier, but it often still takes 6-12 months before people find and secure the right home. We are seeing more sellers accept offers with house-sale conditions, which means you could purchase a property subject to your house selling.

Time is of the essence in all of these scenarios as people still regularly have to compete for properties. I’m working with a couple of people at the moment who have successfully secured their new home with a “subject to house-sale” condition, which was very uncommon a year ago. If you are planning a move, my suggestion is to get your ducks in a row several months before you are planning to move so you can be well prepared.

If you own investment properties there are many things to consider

Keeping property long term continues to be a great choice of investment in my opinion.

Modern properties will become more popular as new rules increase the cost of upgrading older properties. I’d consider upgrading to a higher-spec rental portfolio if you decide to keep using property as part of your investment strategy.

With the introduction of the Healthy Homes Standard, many properties will need upgrading to meet heating, insulation and ventilation requirements. Although these new standards don’t come into play just yet, it isn’t far away. This combined with the discussions around a Capital Gains Tax and the increase in tenants’ rights and landlord restrictions will influence the gains that can be made through property investment and the risk associated with it.

My suggestion is to have a look at property investment as a component of your overall investment strategy. Kiwis have always been really big on property as an investment strategy, and I continue to believe it is a great way to create wealth, but in my opinion should be one of a number of investments to create a diversified portfolio. If you are considering making some changes in your portfolio, I think the next 6-12 months will be a key period to consider.

I speak to many people about the current market and there are plenty of people in the industry who think we have already reached the top of the market. I mention this, not because I agree with them, but out of fairness to you.

We won’t find out when we have reached the peak of the market until it has already happened. The best timing for you depends on your personal circumstances and how the changes affect your portfolio.

For an objective opinion about your portfolio and how the changes might affect your situation, I’d be happy to assess this with you and share my thoughts.

Till next time, Hielke